Introducing India's top-rated

One stop Tax Litigation

Automation Platform

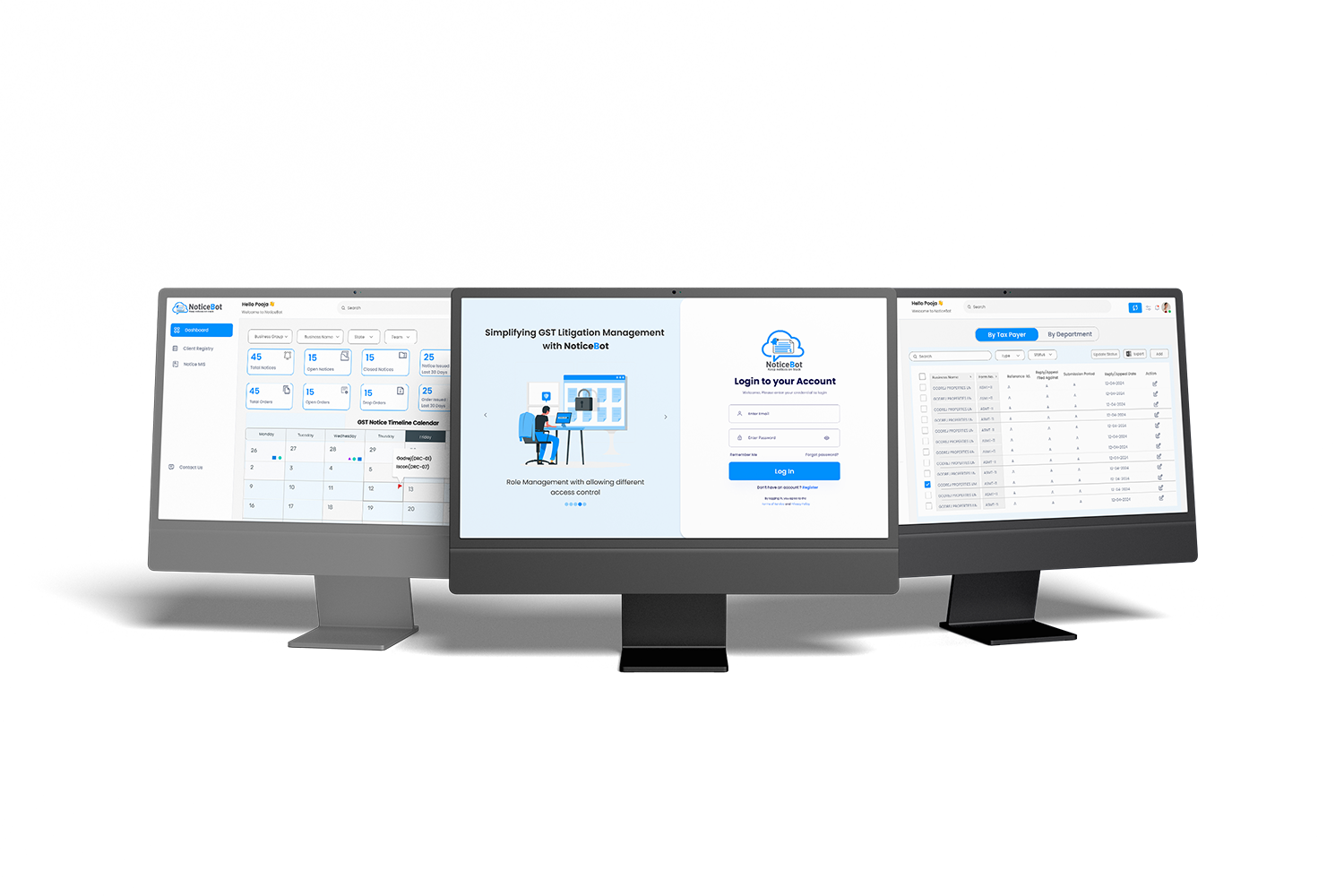

NoticeBot is a groundbreaking solution crafted to streamline and simplify your Goods and Services Tax (GST) litigation compliance.

Offering a comprehensive, one-stop platform for all your tax management needs.

About NoticeBot

Hassle Free Litigation Management

NoticeBot is an innovative platform which is designed to streamline and simplify your Goods and Services Tax (GST) litigation compliance. It helps businesses and individuals to manage GST notices efficiently, ensuring you stay compliant with the latest tax regulations.

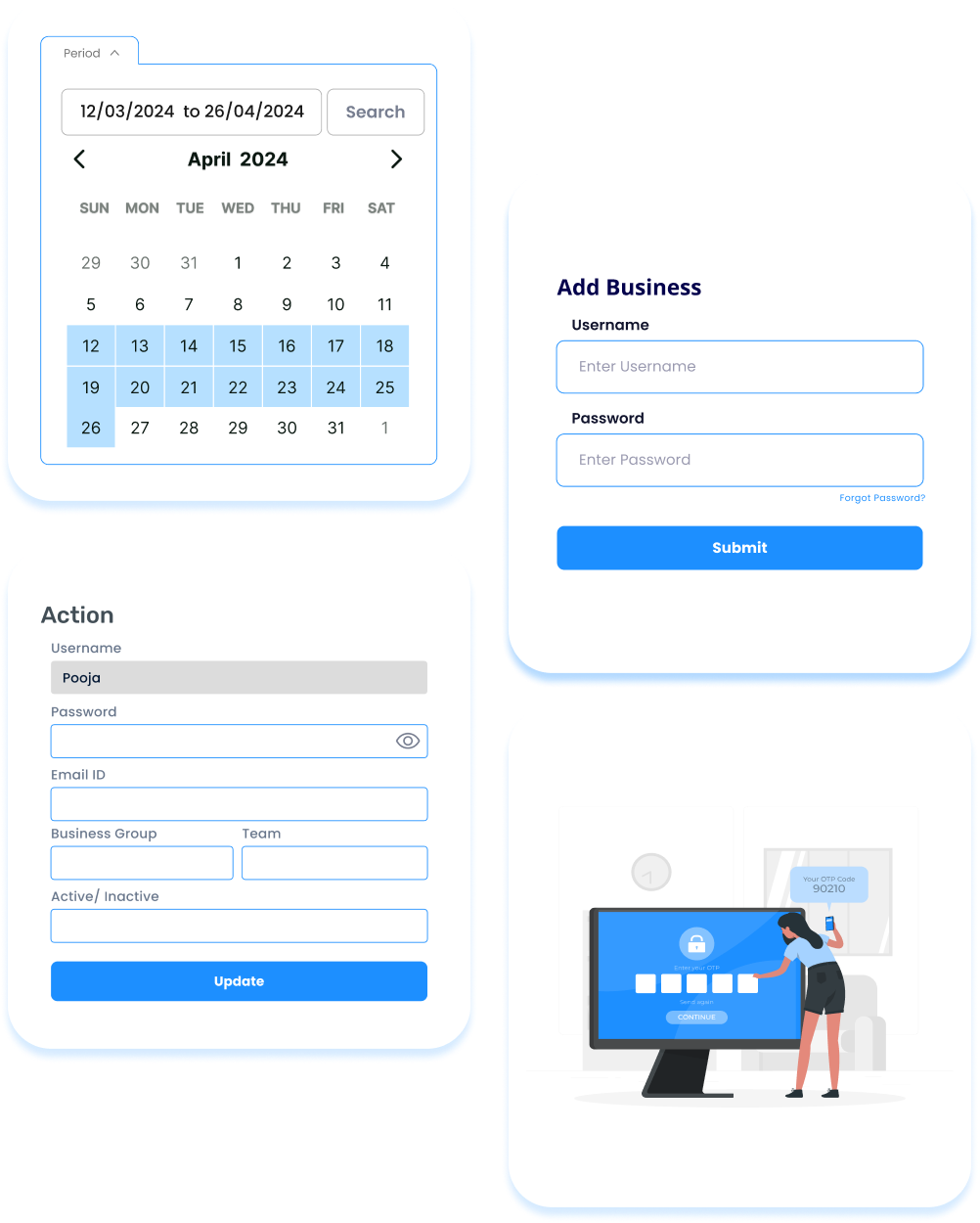

Easy Steps

How it works

01

02

03

04

Sign Up and Setup

Register for NoticeBot and configure your GST account details.

Integrate with the GST portal to enable automated notice retrieval.

Automated Notice Retrieval

NoticeBot fetches all your notices directly from the GST portal.

Get instant notifications about new notices and deadlines.

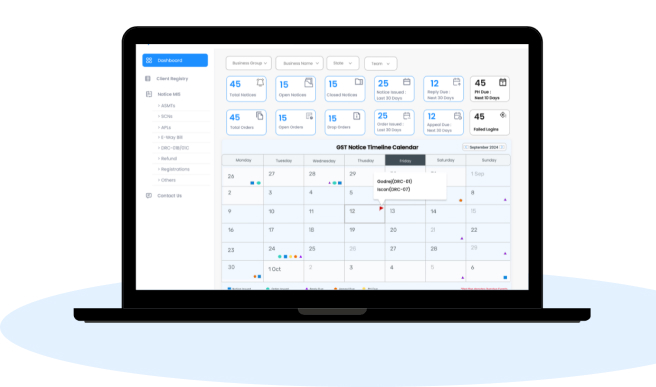

Manage and Respond

View, download, and manage all your Tax notices from the dashboard.

Use our compliance tools to respond to notices and ensure timely submissions.

Stay Compliant

Follow the compliance checklist and use the reminder system to avoid missing deadlines.

Generate and review compliance reports to monitor your status.

Easy Steps

How it works

01

Sign Up and Setup

Register for NoticeBot and configure your GST account details.

Integrate with the GST portal to enable automated notice retrieval.

02

Manage and Respond

View, download, and manage all your Tax notices from the dashboard.

Use our compliance tools to respond to notices and ensure timely submissions.

03

Automated Notice Retrieval

NoticeBot fetches all your notices directly from the GST portal.

Get instant notifications about new notices and deadlines.

04

Stay Compliant

Follow the compliance checklist and use the reminder system to avoid missing deadlines.

Generate and review compliance reports to monitor your status.

Features & Benefits

Automated GST Notice Handling

- Receive Notices Automatically fetch notices from GST and Income Tax portal.

- Notification Alerts Instant alerts via email for new notices

- Document Storage Securely store all your notices and related documents in one place.

Litigation Management

- Due Date Reminders Get timely reminders for upcoming deadlines

- Compliance Checklist Step-by-step guidance to ensure that you meet all GST and Income Tax compliance requirements

User-Friendly Interface

- Easy Navigation Intuitive design for seamless navigation and ease of use.

- Mobile Responsive Access your Tax notices and compliance tools from anywhere, anytime.

Security and Confidentiality

- Data Encryption State-of-the-art encryption to protect your sensitive information.

- Secure Access Encrypted authentication to ensure only authorized personnel have access.

Data Analytics and Reporting

- Insightful Reports Generate detailed reports on your Tax notices, responses, and compliance status

- Dashboard User-friendly dashboard to monitor your GST and Income Tax litigation in real-time.

Why Choose

NoticeBot?

Efficiency

Automate time-consuming tasks and reduce manual errors.

Compliance

Ensure you meet all GST requirements with ease.

Security

Trust that your data is safe with advanced security measures.

Support

Access dedicated customer support for any queries or issues.

Features

NoticeBot is a real-time GST notice update software designed to save both time and money of our subscribers. By efficiently managing GST notices, NoticeBot ensures seamless compliance with the latest tax regulations, keeping our users up-to-date and compliant.

Real-Time Notifications

Instant updates on GST notices as soon as they are issued by auto-fetching notices from GST portal.

Deadline Tracking

Automated reminders for important deadlines to ensure timely responses and avoid penalties.

Cloud based

Access your Tax notices and compliance tools from anywhere, anytime.

Efficient Notice Management

Organized storage and categorization of notices for easy retrieval and tracking.

Centralized Dashboard

A user-friendly interface to view and manage all notices from a single location.

Compliance Alerts

Proactive alerts for regulatory changes and updates to help you stay compliant with the latest tax laws.

Integrated Document Management

Upload, store, and access relevant documents and correspondence directly within the platform.

User-Friendly Interface

Navigate the platform effortlessly with a clean, intuitive design tailored for ease of use.

Secure Access

Encrypted authentication to ensure only authorized personnel have access to ensure the confidentiality and security of your tax information with robust encryption and access controls.

Insightful Reports

Generate reports on notice history, compliance status, and response times for better oversight and decision-making.

Compliance Checklist

Step-by-step guidance to ensure you meet all GST compliance requirements.

Our Subscription Modules

For Corporates /SMEs

For Tax Professionals

No. Only annual subscriptions are available.

Yes, we have topup subscription plans. Please contact our Sales Team for further information.

Yes, you can add more devices in your existing subscription by paying nominal charges per additional

device.

Frequently Ask Questions

If you don’t see an answer to your question, you can send us an email.

Yes, you can contact our team for a trial subscription which is valid for Fifteen days.

Please contact our sales team to convert trial subscription to regular subscription.

Yes, you can get a demo and support during the trial subscription period. For more information, please contact our sales team.

NoticeBot can be run in any web browser. But the preferred browser is Google Chrome.

Yes. You can renew your subscription 1 month before it expires. We recommend that you renew the subscription timely to avoid any disruption in your work. Please note that even if you renew your subscription before expiry, it will still be extended from the expiry date and you will not lose any subscription period.

If you have forgotten to renew a subscription and it has expired, you can still renew it by contacting our sales team. In this case, renewal will be applicable as pro rata basis.

Please contact our sales team for subscription renewal.

Your data will not be deleted by Clouddesk. But you will not be able to access your data, until you renew your subscription.

We accept online payments made using Internet Banking, Mobile Wallets, UPI and NEFT. We also accept offline payments through Cheque and DD. We do not accept payment in Cash.

No. Once the subscription has been purchased, the amount paid cannot be refunded.

Please contact our sales team for Bank Details.

Please first check the bank account that you used to make the payment.

If the money has not been deducted from your account, you can safely retry the payment,

If the payment has been deducted from your wallet/account, then please wait for 3 business days. As soon as we receive the payment confirmation from our bank, we will process the request and issue the subscription.

Trust begins with Trials!

Blogs

Understanding GST Notices and How to Stay Safe from them.

Date: 09-08-2024

The key component of India’s tax system, the Goods and Services Tax (GST), has an effect on companies in a number of industries. But for any business owner…

Seamless Litigation Monitoring with our pro solution. Real-time radar for Goods & Services Tax notices.