Our Publications

“Life is a gift, and it offers us the privilege, opportunity and responsibility to give something back by becoming more.”

About Us

KMS Editorial Board

KMS Publications is a new-age publication house publishing books that helps tax professionals deal with modern and new-age tax systems. KMS Publications has a highly qualified team of Chartered Accountants, Company Secretaries, and Lawyers. This team operates under the guidance and supervision of CA. Amish Khandhar and CA. Rashmin Vaja.

The Research and Editorial Team creates reliable content for readers. At KMS, we prioritize transparency, trust, and confidence in our environment. Our team diligently follows publication guidelines when developing content. The statutory material is obtained only from authorized and reliable sources, to keep readers informed about the latest developments in the judicial and legislative fields.

We Prepare analytical write-ups on recent, controversial, and contagious issues to help the readers understand the event and its implications.

Any evidence-based statements are accompanied by proper references to Section, Circular No., Notification No., or citations.

GST Margdarshak by KMS Publication – Gujarati Magazine for 2025 (Monthly)

GST Margdarshak by KMS Publication – Gujarati Magazine for 2025 (Monthly)

This book includes updated and annotated content for GST, Income Tax, and related legislations along with Economic updates, Tech Talks and valuable insights on life.

Price Rs. 3750 for 12 Magazines

GST – Goods and Services Tax in Gujarati (A Set of 3 Books) – Latest 2023-24 Edition by CA. Amish Khandhar & CA. Rashmin Vaja – KMS Publications

KMS GST Acts with Rules, Forms / Notifications and Procedure as Amended by Finance Act 2023 Edition 2023.

Volume 1 offers the amended Budget of 2024, including GST and income tax summaries, significant 116 GST tables, GST exemptions, and relevant Supreme and High Court Judgments and AARs. The book also provides Frequently Asked Questions.

Volume 2 provides a comprehensive introduction to the Goods and Services Tax, including key concepts such as Place of Supply, Value of Supply, and Location of Supplier. It also offers detailed information on the Input Tax Credit mechanism.

The book further explains the requirements for tax invoices, debit notes, and credit notes, while also addressing key processes like E-Invoicing, E-way Bills, and GST Returns. Additionally, it outlines the GST Refund Procedure and the functions of an Input Service Distributor (ISD).

Volume 3 provides detailed information on the amendments introduced in the 2024 Budget, along with updates to the Gujarat Bare SGST Act & Rules for 2024. It also includes the latest HSN/SAC codes and outlines the current SGST and CGST jurisdictions.

Price Rs. 3500/- for 3 Volumes

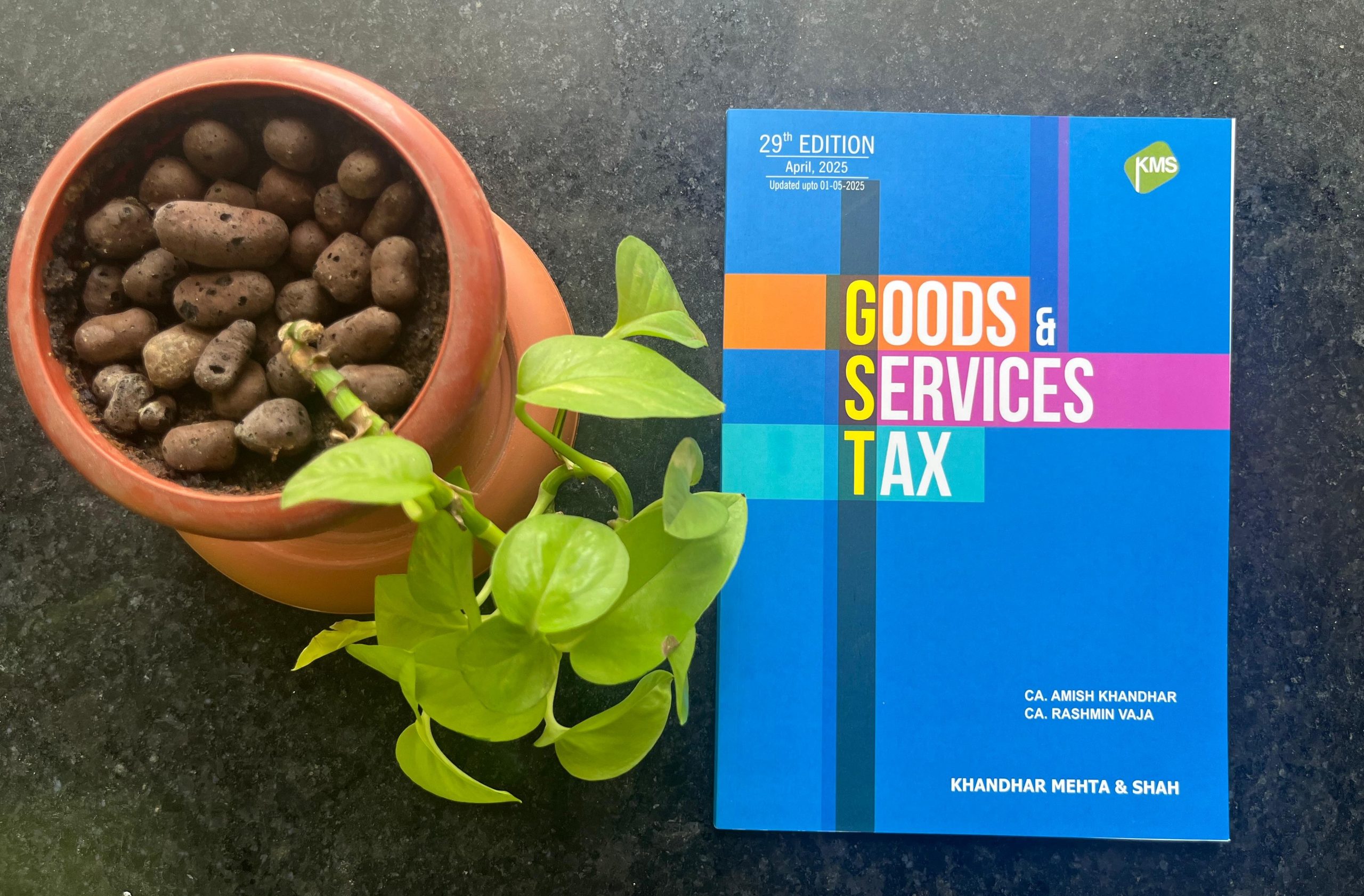

GST – Goods and Services Tax Chart Book in English 29th Edition by CA. Amish Khandhar & CA. Rashmin Vaja – KMS Publications

This book contains GST Compliances and other related Details in Tabular Format and a lucid and easy-to-comprehend manner.

Price Rs. 300/-

21 Useful Charts for Tax Compliance for Financial Year 2024-25 by KMS Publications

This book features useful charts designed to assist with tax compliance across various areas, including Income Tax, GST, the Companies Act, PF-ESIC, International Taxation, TDS/TCS rates, MSME registration, and Stamp Duty.

Price Rs. 300/-

GIFT CITY Handbook by CA. Amish Khandhar & CA. Vipul Gandhi - KMS Publications

This particular handbook provides comprehensive insights about establishing IFSC and other norms required for IFSC in the GIFT CITY.

Price Rs. 250/-

GST Margdarshak by KMS Publication – Gujarati Magazine for 2024 (Monthly)

GST Margdarshak by KMS Publication – Gujarati Magazine for 2024 (Monthly)

This book includes updated and annotated content for GST, Income Tax, and related legislations along with Economic updates, Tech Talks and valuable insights on life.

Price Rs. 3750 for 12 Magazines

GST – Goods and Services Tax in Gujarati (A Set of 3 Books) – Latest 2023-24 Edition by CA. Amish Khandhar & CA. Rashmin Vaja – KMS Publications.

KMS GST Acts with Rules, Forms / Notifications and Procedure as Amended by Finance Act 2023 Edition 2023.

Volume 1 offers the amended Budget of 2024, including GST and income tax summaries, 116 significant GST tables, GST exemptions, and relevant Supreme and High Court Judgments and AARs. The book also provides Frequently Asked Questions.

Volume 2 offers an introduction to the Goods and Services Tax, covering the Place of Supply, the Value of supply, Location of Supplier and information on the Input Tax Credit. The book also includes a tax invoice, a debit note, and a credit note, as well as an E-Invoice/E-way Bill/GST Returns, GST Refund Procedure, and an input service distributor (ISD).

Volume 3 offers information regarding the Gujarat Bare SGST Act & Rules for 2024 updated HSN/SAC codes and SGST and CGST Jurisdictions.

Price Rs. 3500 for 3 Volumes

GST – Goods and Services Tax Chart Book in Gujarati and English 27th Edition by CA. Amish Khandhar & CA. Rashmin Vaja – KMS Publications

This book contains GST Compliances and other related Details in Tabular Format and a lucid and easy-to-comprehend manner.

Price Rs. 250 (English) and Rs.250 (Gujarati)

21 Useful Charts for Tax Compliance for Financial Year 2023-24 by KMS Publications

This book contains information on income tax, GST, the Companies Act, PF-ESIC, international taxation, TDS/TCS rates, MSME registration, and stamp duty.

Price Rs. 250

GIFT CITY Handbook by CA. Amish Khandhar & CA. Vipul Gandhi – KMS Publications

This particular handbook provides comprehensive insights about establishing IFSC and other norms required for IFSC in the GIFT CITY.

Price Rs. 250

Seamless Litigation Monitoring with our pro solution. Real-time radar for Goods & Services Tax notices.